Beneficiary Designation Gifts

|

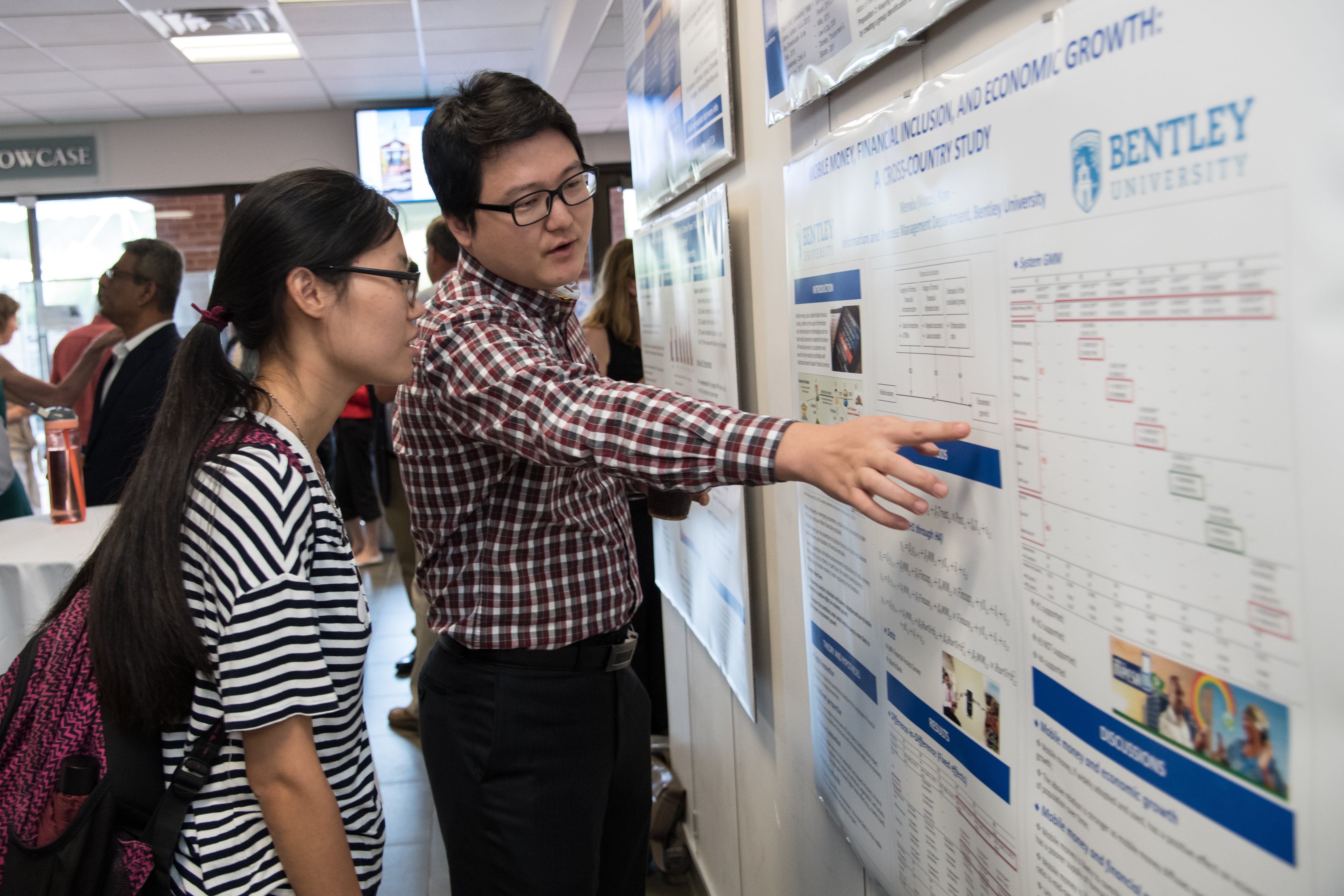

| Help Bentley provide the education students of the future will demand; a cutting-edge and hands-on business curriculum fused with liberal arts. |

A beneficiary designation is one of the simplest ways to make a gift to Bentley. It's literally as easy as filling out a form.

A beneficiary designation asset is one that transfers at your passing according to the instructions you have indicated on its designation form. You specify the individuals and organizations you want to receive the asset at your passing. You indicate the percentage of the asset you want each beneficiary to receive, and whether a beneficiary is primary or contingent. To name Bentley a beneficiary, use “Bentley University” and Tax ID number, 04-1081650.

Beneficiary designation gifts are often considered an alternative form of bequest because they pass outside of your will or living trust. Because they transfer directly to named beneficiaries, you do not need to modify your will or living trust to make these kinds of gifts.

Gifts of the following assets may be transferred by beneficiary designation:

Retirement Assets

By designating Bentley as the beneficiary of your retirement plan, you arrange for a future gift to Bentley in a simple way. All you have to do is request a new beneficiary designation form from your plan administrator, and complete and return it to them. In many cases, the process can be completed online – you can access the beneficiary designation form yourself, and make and save the changes.

A gift of retirement assets has the added advantage of being among the most tax-wise ways to make an estate gift. This is because your retirement assets, if left to individuals, will be subject to income tax when distributions are made, and, in the case of a non-spouse, those distributions may be accelerated.

With a gift to a non-profit, such as Bentley, your retirement asset is not taxed – therefore, 100 percent of the funds become available for Bentley’s use. If you want to remember us in your estate plan, it is often better to leave other types of assets – cash, securities, real estate – to your heirs and give retirement assets to Bentley.

Retirement assets include traditional IRAs, Roth IRAs, 401(k)s, and 403(b)s.

Life Insurance

Life insurance policies can also be used to make a gift to Bentley. As described above, you may request, complete and return to the insurance company a form designating that Bentley is to receive all or a portion of the death benefit associated with your life insurance policy. As an alternative to naming Bentley as the beneficiary, you can transfer ownership of the policy (subject to Bentley’s acceptance) during your lifetime. Transferring ownership results in an immediate income tax charitable deduction and potential income tax savings in the year of the gift.

Bank Accounts

You can instruct your bank to pay Bentley all or a portion of what remains in a checking or savings account at your passing. The process is usually known as POD, which stands for payable on death. Your bank can provide you with the appropriate beneficiary designation form to note that your account should be POD to Bentley.

Brokerage or other financial accounts

Instruct your brokerage firm to TOD to Bentley some or all of a specific brokerage or other financial account. (TOD stands for transfer on death.)

Commercial Annuity Contracts

A commercial annuity will sometimes have a remaining value at the end of the annuitant’s lifetime. You can name Bentley to receive all or part of this amount by designating it as a sole or partial beneficiary on the appropriate form from the insurance company.

Donor Advised Funds

If you have a Donor Advised Fund charitable giving account, you can designate Bentley as a beneficiary of your account after your passing. The Donor Advised Fund sponsor would then distribute any funds remaining in your account after your passing to Bentley.

Investment Accounts

You can instruct your brokerage firm or investment company to transfer to Bentley some or all of the remaining investments held in your account at the time of your passing. Your broker or advisor can let you know the process for doing this – it may be as simple as adding “TOD to Bentley University,” which stands for Transfer on Death, after your name on the account.

If you have named Bentley a beneficiary of any of these assets, kindly let us know so that we may thank you, and also so that we can ensure that your gift can be used in the manner you intend. Since beneficiary designation forms often have limited space, if you wish that your gift be used for other than Bentley’s general purposes, we may recommend brief additional documentation. This documentation would be drafted with your input and you and a Bentley representative would sign it, showing that both parties have agreed how your gift should be used when we receive it.