Four Ways to Give Real Estate

Whether in the form of a residence, a commercial or investment property, or undeveloped land, real estate is among the best assets to use for charitable giving. In almost all cases, the tax savings are substantial, and you can tailor the gift to meet your financial needs.

Below are brief descriptions of the most popular ways to give real estate. We invite you to explore your options and see just how much you and Bentley can benefit from a gift of real estate. Then, if you’d like to learn more, request our new brochure or contact our office.

Give it free and clear. The most popular way to make a gift of real estate is to give the property outright. In the majority of cases, giving property outright maximizes your charitable income tax deduction, your capital gains tax savings, and your charitable impact. Your income tax deduction would be equal to the property’s full fair market value, and if it has appreciated since you acquired it, no capital gains tax would be due.

Give some, get some. If your goals include obtaining immediate cash as well as tax benefits, consider selling your property to Bentley at a mutually acceptable price that is less than its fair market value. This gift structure, known as a bargain sale, allows you to receive an immediate cash benefit equal to the sale price, an income tax deduction for the difference between the sale price and the property’s appraised value, and a reduction in capital gains tax.

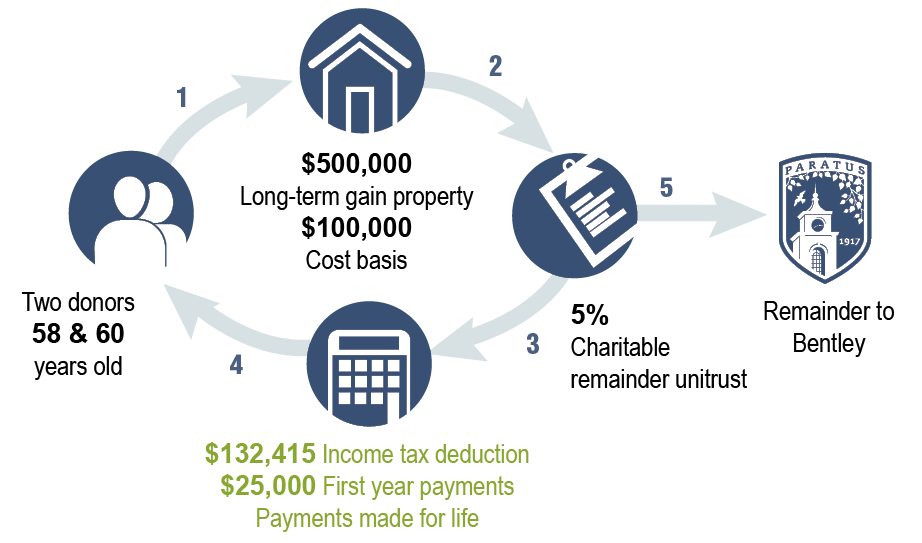

Give in exchange for income. Do your financial objectives include creating an income stream? If so, you could contribute your real estate to a charitable remainder unitrust. When the property sells, you would start to receive income designed to continue for the rest of your life, which also has the potential to increase over time. Plus, you would receive a substantial income tax deduction. In addition, there would be no immediate capital gains tax on the sale of your real estate.

Example: Audrey Chen is 60 years old and her husband John is 58. They bought a vacation home for $100,000 and the home has appreciated substantially in value over the many years the Chens have owned it. They are enthusiastic about making a major gift to support Bentley, but they also would welcome a way to receive income. After consulting with their advisor, the Chens find that a 5% charitable remainder unitrust funded with their home valued at $500,000 will meet their needs perfectly. They will receive an immediate income tax deduction of $132,415* and $25,000 in first year payments.

*The Chens’ income tax charitable deduction may vary depending on the timing of their gift.

Give and retain full use for life. You can give your primary residence or vacation home to Bentley now, and retain full use of the property for the rest of your life. This type of gift arrangement, known as a retained life estate, allows you to keep your current lifestyle with respect to that property while obtaining a significant income tax charitable deduction. Down the line, if you need to move for health or other reasons, you have several options, which are described in our new brochure.